This process is usually handled by a collections division or collection agencies. Accounts receivable symbolize funds owed to an organization and are booked as an asset. Accounts payable, however, represent funds that an organization owes to others and are booked as liabilities. With Out proper AR monitoring, businesses danger running out of money even while showing a profit on paper.

Working Money Circulate

And don’t shrink back from these tough love moments; if a shopper habitually pays late, it may be time to half methods. Carried Out proper, these strategies can remodel your AR from a supply of stress to a dependable, well-oiled machine. Any measure that your small business takes to observe or seize the income from credit-based purchases would require expertise and personnel—resources that you want to pay for.

Our group are right here that will help you scale up to take advantage of both your home and international customers. We have product specialists based around the globe, from automotive and automobiles, to media and information. The TFG receivables finance team works with the necessary thing decision-makers at over 270 banks, funds and alternative lenders globally, helping companies in accessing receivables finance services. This utilization has some issues as a outcome of errors in ascertaining the collectability of the invoices delivered could harm the score of the corporate with out other options. Get solutions to your particular questions and find out why PDCflow is the best selection for esignatures, documents, and funds.

- Software Program that automates your accounts receivable processes will assist hold your common DSO low and create a good expertise for your clients.

- Coming to some sort of settlement with the shopper is kind of at all times the much less time-consuming, inexpensive possibility.

- Moreover, these accounts imply different things to completely different actors contained in the market or the corporate.

- For stakeholders, a method more essential kind of presentation in relation to accounts receivable is for the six kinds of KPI which might be instantly affected by them.

Take Control Of Your Monetary Journey Today

The necessary thing to notice accounts receivable common term and definition is that the accounts receivable definition doesn’t limit itself to any kind of business and customer. A/R simple consists of short-term money owed that clients owe the enterprise for purchases made on credit score. The terms, due dates, and credit limits range among businesses and industries. The total value of liquid investments that may be quickly converted to cash without lowering their market value is entered into the marketable securities account.

For smaller companies that have fairly homogenous receivable accounts, it could be simpler to stability all the accounts as they’re with nominal asset values and no further investigation. As such, they can be offered to the mortgage giver as collateral and safety for any mortgage taken by the company. There are two ways to utilise accounts receivable as collateral together with your bank or other forms of credit score line provider.

These methods are important for scaling companies, significantly in tech-driven industries the place money flow predictability helps innovation. In the context of startups and growth-stage corporations, sturdy AR practices sign financial self-discipline, making companies extra engaging to buyers throughout fundraising rounds. Poor AR handling, conversely, can lead to dangerous money owed, eroding earnings and damaging credit scores. For occasion, in B2B sectors like manufacturing or SaaS, corporations typically offer 30- to 90-day cost phrases to foster loyalty and sales volume.

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. This cash is typically collected after a few weeks and is recorded as an asset on your company’s balance sheet. This section is necessary for traders as a end result of it exhibits the corporate’s short-term liquidity. Apple could liquidate these belongings to assist cowl its money owed if it were to expertise issues paying its short-term obligations. Tackling uncertain debts and organising bad debt provisions is like weatherproofing your steadiness sheet against potential storms.

As Accounts Receivables enable a company to track and document payments owed for goods or services rendered, they can be automated by using digital applied sciences to carry out and solve some manual tasks. Automation reduces (and in some instances altogether eliminates) the necessity for labor-intensive spreadsheet creation and handbook data entry. Firm B now owes Company A money, so it lists the bill in its accounts payable column.

(E) a person who is said by blood or marriage to an individual described in subparagraph (A), (B), (C), or (D) and shares the same residence with the person. (D) include raw materials, work in process, or materials used or consumed in a business. (C) whose effectiveness doesn’t depend on the particular person’s possession of the personal property. Otto AI and similar instruments help small businesses take management of AR with out manual spreadsheets. Contact us right now to explore tailored financial solutions that drive your startup’s growth. We develop tailor-made growth plans and dynamic monetary fashions to information decision-making and drive scalable, sustainable success.

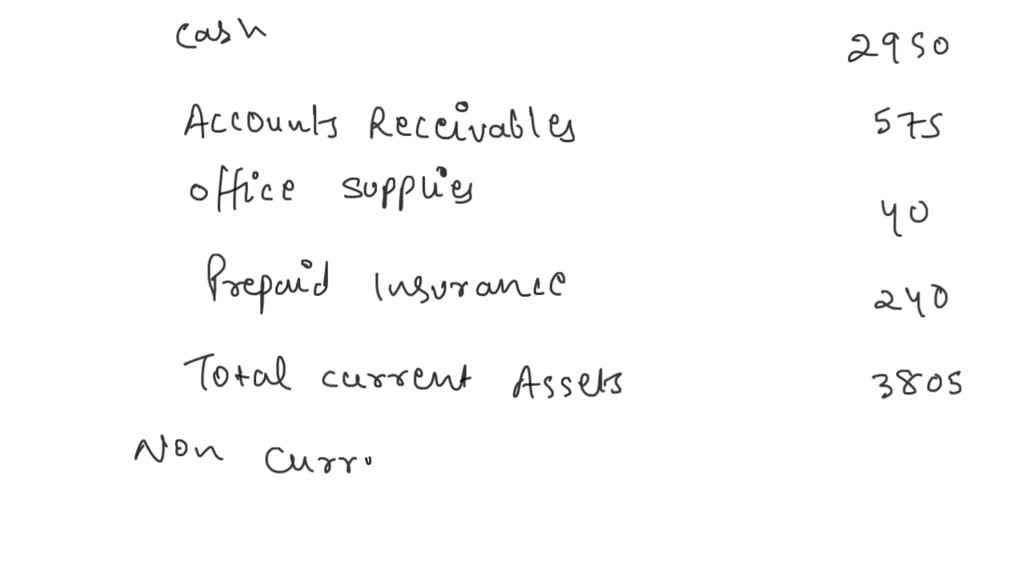

Furthermore, accounts receivable are categorised as current property, because the account balance is anticipated from the debtor in one yr or much less. Other current belongings on an organization’s books might include money and money equivalents, inventory, and readily marketable securities. Receivables are money owed owed by clients to an organization for purchased companies or merchandise on credit. A/R is recorded as an asset on the stability sheet till they’re collected or written off. They can be used, a minimum of partially, to match with accounts payable to minimize back the stress of bills on the liquidity of the company. Underneath accrual accounting, income is recorded simultaneously an account receivable, reflecting the sale made on credit score.

While it doesn’t immediately change money on hand, it does impact the whole revenue reported. Late payments from clients are one of the high the purpose why companies get into money flow or liquidity problems. The total worth of all accounts receivable is listed on the steadiness sheet as current property and include invoices that shoppers owe for items or work carried out for them on credit. Most companies operate by permitting a portion of their sales to be on credit. Typically, businesses offer such credit to frequent or particular clients, who receive periodic invoices rather than having to make payments as every transaction occurs. In different cases, businesses routinely provide all of their shoppers the ability to pay within some affordable interval after receiving the services or products https://www.personal-accounting.org/.